Important Takeaways:

- What Is Going To Happen To Our Society As AI And Robots Take Most Of Our Jobs?

- For years we have been warned that AI and robots would revolutionize the workforce, and now that day has officially arrived.

- For example, Amazon has been using various types of simple robots to perform certain tasks for years, and now highly sophisticated humanoid robots are being deployed right alongside normal human workers…

- Designed by Agility Robotics, which Amazon has invested in as part of its Industrial Innovation Fund, Digit is only the latest of a string of warehouse robots the company has introduced over the last several years. However, most of the other warehouse robots have been cart-shaped or robotic arms, not humanoid like Digit.

- Digit costs about $10 to $12 an hour to operate right now, based on its price and lifespan, but the company predicts that cost to drop to $2 to $3 an hour plus overhead software costs as production ramps up, Agility Robotics CEO Damion Shelton told Bloomberg.

- So this trend is only going to accelerate during the years ahead.

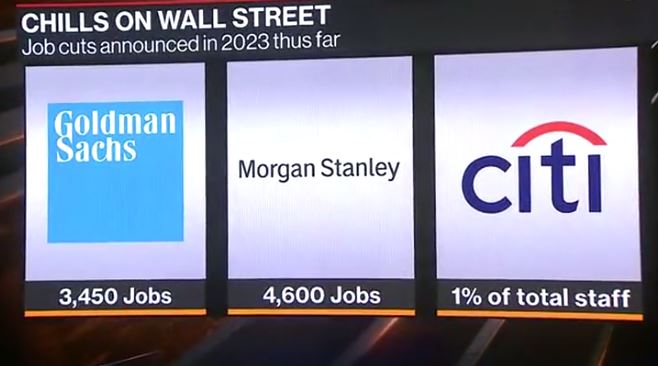

- In fact, Goldman Sachs is projecting that AI could take as many as 300 million full-time jobs during the years ahead, and most of them will be white collar jobs…

- As many as 300 million full-time jobs around the world could be automated in some way by the newest wave of artificial intelligence that has spawned platforms like ChatGPT, according to Goldman Sachs economists.

- They predicted in a report Sunday that 18% of work globally could be computerized, with the effects felt more deeply in advanced economies than emerging markets.

- That’s partly because white-collar workers are seen to be more at risk than manual laborers. Administrative workers and lawyers are expected to be most affected, the economists said, compared to the “little effect” seen on physically demanding or outdoor occupations, such as construction and repair work.

- On Friday, the BLS told us that the Establishment Survey indicated that the U.S. economy added 216,000 jobs last month, but historically the Household Survey has been much more accurate, and it showed that the U.S. economy actually lost 683,000 jobs last month…

- And as I shared with my paid subscribers a few days ago, the BLS report also showed that the number of full-time jobs in the U.S. dropped by 1.531 million during the month of December…

- Meanwhile, bankruptcies are surging all over the country.

- In fact, the number of bankruptcy filings in the United States in 2023 was 18 percent higher than it was in 2022…

- But what we are experiencing at this moment is not even worth comparing to what is coming.

Read the original article by clicking here.